Deduct This!

Who invented the double entry bookkeeping system?

The best place to begin a journey into

accounting is at the start. Double entry bookkeeping was originally devised by

the Italians in the fifteenth century.

What are the principles used for in business?

The principles of double entry bookkeeping are

used for recording financial transactions that occur within a company.

Financial information accounts are recorded in the book called a nominal ledger

or another term is often used is the general ledger. An account is a page in

the ledger. These accounts in the ledger are usually called as T accounts. For example

a nominal ledger set up for assets where information about machinery or

furniture will be recorded. Other ledgers would be for rent, lighting and heat,

sales, purchases etc.

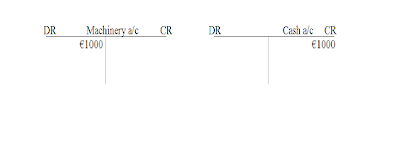

Here is an example of a T account that would be

recorded in a ledger.

What is meaning of the term “double entry” in bookkeeping?

The words “double entry” explains that each

transaction that occurs within a business, that transaction must be recorded

twice. To do this with a ledger account we must split the page in two where on

the left it is called a Debit (DR) and on the right it is called a Credit (CR)

as above.

You might be asking yourself why do I need are

there two parts of the accounts? The answer to that is each transaction has two

parts. In other words each transaction has a debit and credit to it.

To find out more about debits and credits check

out this link:

Uploaded by bigbeancounter

on 19 Jun 2009

Uploaded by danieldickson2 on 18 Feb 2011

lecture 3:debits and credits

Accounting Basics Lesson 3.1: How Does Double-Entry Accounting Work, What are Debits and Credits

Uploaded by danieldickson2 on 18 Feb 2011

Here is an example of the double entry book keeping:

Trapattoni Ltd. buys a machine for €1000 cash. Here

we have two parts of a transaction. First the company has obtained a machine

worth €1000. Also the company has lost cash of €1000. The company records this

information in two accounts. The company records an increase in the machinery

account and it records a decrease in the cash account.

Which account do I debit and which do I credit?

The answer is we debit the receiving account

and credit the giving account. This is also referred to as the Golden Rule of Accounting.

The reason why this rule is so is because that’s what the Italians decided back

in the fifteenth century. They for all

could have swamped this rule around if they so wished.

The company receives a machine for €1000 so it

is recorded on the debit side and the company spent €1000 so it is recorded on

the credit side.

Basic principles of double entry bookkeeping

Uploaded by 3minstermsandcondit

on 31 May 2011

Types of Transactions

I can hear you asking “Wait, aren’t there

different types of transactions, how will I know where to put them in the

accountants?”

A wonderful question to ask! To answer it there

are four types of transactions: Assets, Liabilities, Expenses and Incomes.

You must remember your double entry. On the Debit

side there will be assets and expenses. This will always be the case.

On the Credit side it will be liabilities and

incomes. As same as above they will always be credits. The Liabilities and

Assets will only appear in the balance sheet and Incomes and Expenses will

appear in the income statement. The balance sheet and income statement will be

explained later on in your studies.

Hmm I think I get it, do you have an example I can examine?

Of course, Keano Inc. has transactions that

have occurred within the month of June 2011. They need an accountant to record

these transactions within the accounts. They are as follows:

Shareholders invest €10,000 into the business

on June 2nd.

The company purchases €2000 worth of equipment

on June 5th.

Purchases were made costing €5000 on June 8th.

The company pays wages of €1000 on June 10th.

Rent of the building comes to €1000 on June 25th.

Keano sales for June were €5000.

Here we have a nominal ledger which contains

several accounts of a firm. As you can see some of the figures of the accounts

are on either the left or right side of the T account. As we mentioned before, there are four types

of transactions. Can you name them above?

We can also see the figures being double

entered. Where rent €1000 appears on the debit side of the rent account it

appears on the credit side in the cash at bank account. This goes back to what

was mentioned earlier, there is two sides to every transaction!

As seen in the cash at bank account the company

has a debit balance. This means that the company has brought in more money than

spent over June. If we had a credit balance it would be a Liability in which

the firm would have to get a loan.

Why should I learn this double entry bookkeeping, can’t I get a computer to do this?

I hear you asking “Why can’t I do this on a

computer, would it be faster and easier” It is true a computer can do this but

a person has to know how to input the data into the system. This means they

must understand where each transaction or a group of transactions should go. If

a shareholder of a company asks you the Accountant, “Why did you put machinery

in to accounts of the books, should it not be in only one account?” It would

make you look very silly and your job in danger if you could not explain to the

shareholder the basic concept of double entry!

Why should I be an accountant?

There are

so many reasons to pursue a career in accountancy it can be best summed up with

these videos.

This comment has been removed by the author.

ReplyDeleteThanks for the comment Charles. Always nice to get some feedback.

DeleteI’m impressed with the special and informative contents that you just offer in such short timing.www.smecloudaccounting.co.uk

ReplyDeleteThank you for sharing such valuable and helpful information and knowledge! This gives us more insights and inspiration. Looking forward to seeing more updates from you.

ReplyDeleteTax Checklists

Having bookkeeping, you can identify money-making opportunities, avoid cash-flow problems, and find ways to increase income or decrease spending. Bookkeeping For Contractors

ReplyDeleteThanks mate. I am really impressed with your writing talents and also with the layout on your weblog. Appreciate, Is this a paid subject matter or did you customize it yourself? Either way keep up the nice quality writing, it is rare to peer a nice weblog like this one nowadays. Thank you, check also event marketing and Adoption of Mobile Event Apps

ReplyDeletethanks dear I like it and share it to my friends also

ReplyDelete.tv stand

Contact Outbooks to leverage potential of our certified bookkeeping services business scale new heights with accurate books.

ReplyDeletewell said ...

ReplyDeletealso if anyone looking accounting bookkeeping service

visit us our service

Bookkeeping service

Bookkeepers Ireland

Irish Accounting firm in Ireland